Uncertainty Over KISD Split Triggers 139% Surge in Home Listings

An Analysis of Listing Trends Before and After January 9, 2025

On January 9, 2025, news broke that Keller Independent School District (KISD) was considering a split. Since then, there has been widespread discussion about what this could mean for homeowners, property values, and the future of the district.

This report focuses on new home listings, which serve as an early indicator of shifts in homeowner sentiment. If uncertainty surrounding the split is prompting more residents—particularly on the West side—to list their homes, it could signal an emerging supply-side pressure that may, over time, affect property values.

Key Takeaways:

- The number of new home listings on the West side surged immediately following the KISD split news.

- Year-over-year comparisons show an unusual increase in West-side listings, while the East side remains stable.

- While this has not yet affected home values, sustained increases in supply could eventually impact pricing.

- The uncertainty surrounding the split is creating instability—prolonging the decision may further accelerate the trend.

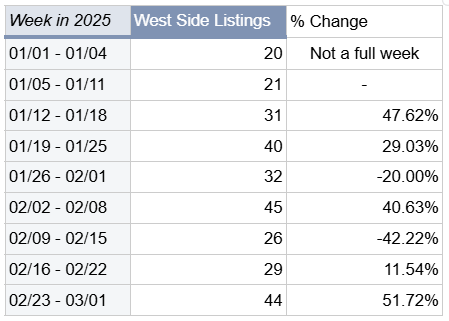

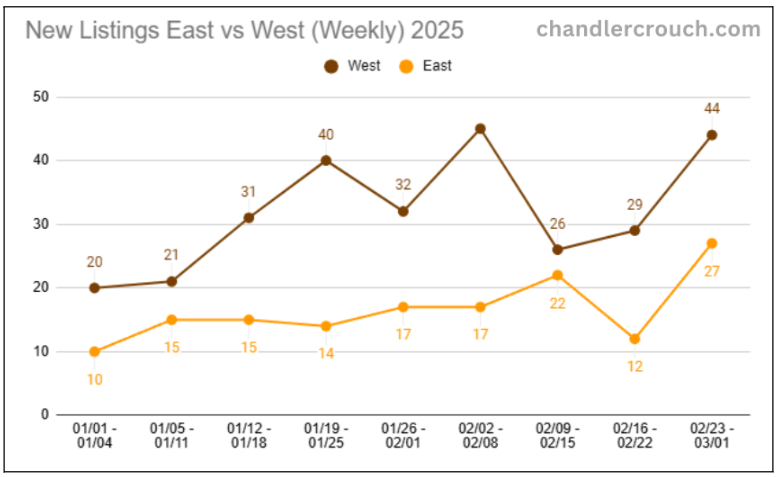

New Listings Surge on the West Side Following Split News

A clear shift occurred in the first full week after the January 9, 2025, announcement:

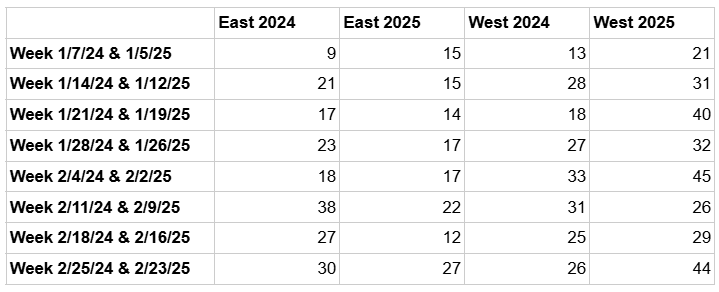

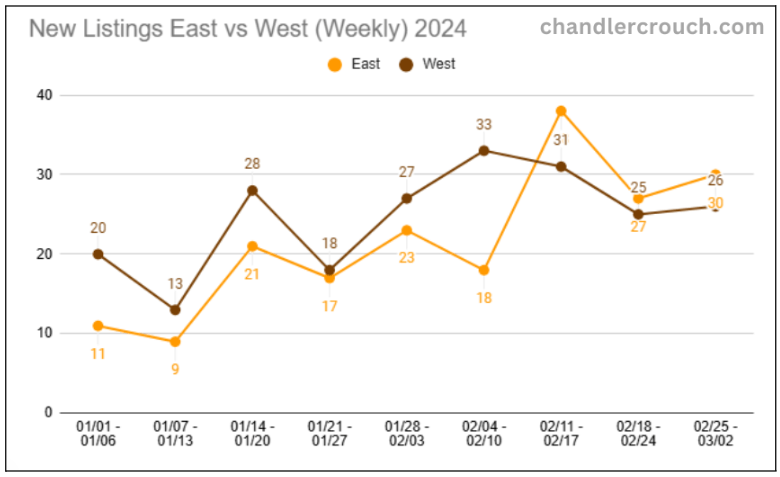

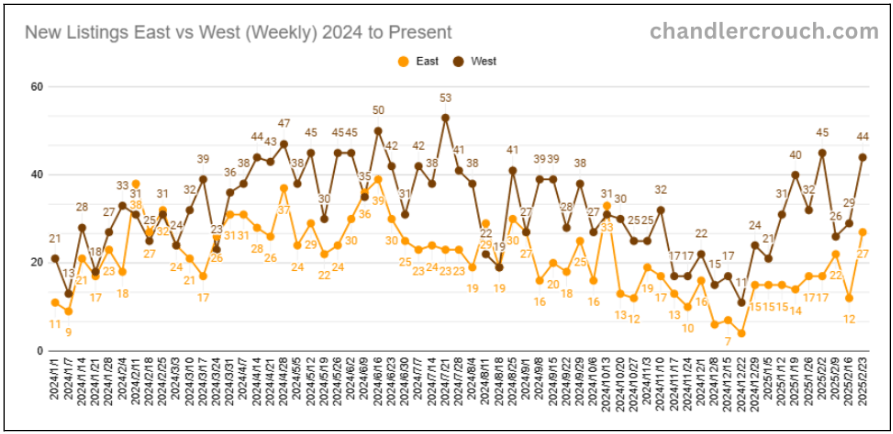

This pattern is not consistent with normal market seasonality. In 2024, the West side had only 13 listings in the same week where 2025 saw 31—a 139% increase.

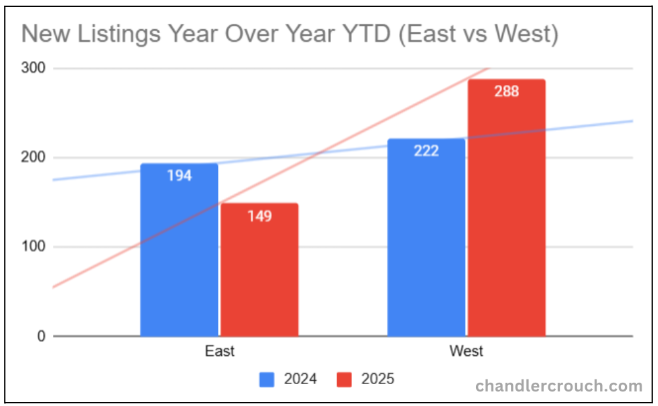

West Side vs. East Side: A Clear Divergence

If the increase in listings were simply due to normal market cycles or broader real estate trends, both sides of the district should exhibit similar patterns, however, that is not the case.

While the West side is seeing a dramatic increase in listings, the East side is not experiencing the same level of volatility. This suggests that the surge in listings on the West side is a reaction to the KISD split news rather than a market-wide trend.

Limitations and Considerations

While the data strongly suggests that the KISD split news has influenced the surge in new listings on the West side, the following factors should be considered:

- Correlation vs. Causation: The timing of the increase aligns with the KISD split news, but other economic factors (such as interest rates or seasonal changes) could also play a role. However, if macroeconomic conditions were the main cause, the East side would likely show similar increases, which it does not.

- Short-Term vs. Long-Term Trends: This report focuses on new listings, which are an early market indicator. The impact on property values may take longer to materialize.

- Market Resilience: The Texas real estate market is strong and can absorb short-term fluctuations in supply. However, if listings on the West side continue to rise without equivalent demand, it could eventually have a significant impact on home values.

Conclusion: A Tipping Point is Forming

This report presents clear evidence that homeowners—particularly on the West side—are responding to the KISD split news by listing their properties at an accelerated rate.

- New listings surged by 48% in the week following the January 9, 2025, announcement.

- Year-over-year increases of 67–139% indicate this is an unusual market shift.

- The East side has remained stable, suggesting the change is specific to the split news rather than a broader market trend.

- While property values have not yet been affected, continued increases in supply will inevitably create pressure.

The Role of Uncertainty

At this stage, uncertainty, not necessarily the split itself, is the primary issue. Homeowners on the West side may be responding to the unknowns rather than the actual consequences of a split.

- If the decision is prolonged, further instability in the market could occur.

- If the split moves forward, a second wave of listings could follow, amplifying supply-side pressure.

- If the split is abandoned, the market may stabilize, but the uncertainty has already created measurable disruption.

The real estate market is beginning to react, and the longer uncertainty remains, the greater the risk of long-term consequences.

Final Thoughts

Real estate is a function of supply and demand. Right now, supply is increasing at an abnormal rate on the West side while the East side remains relatively stable. While high demand has prevented immediate price impacts, if this trend continues, basic market principles suggest that home values will eventually reflect the imbalance.

This report presents an objective analysis of measurable real estate trends and serves as a warning sign for potential long-term impacts if uncertainty is not addressed.