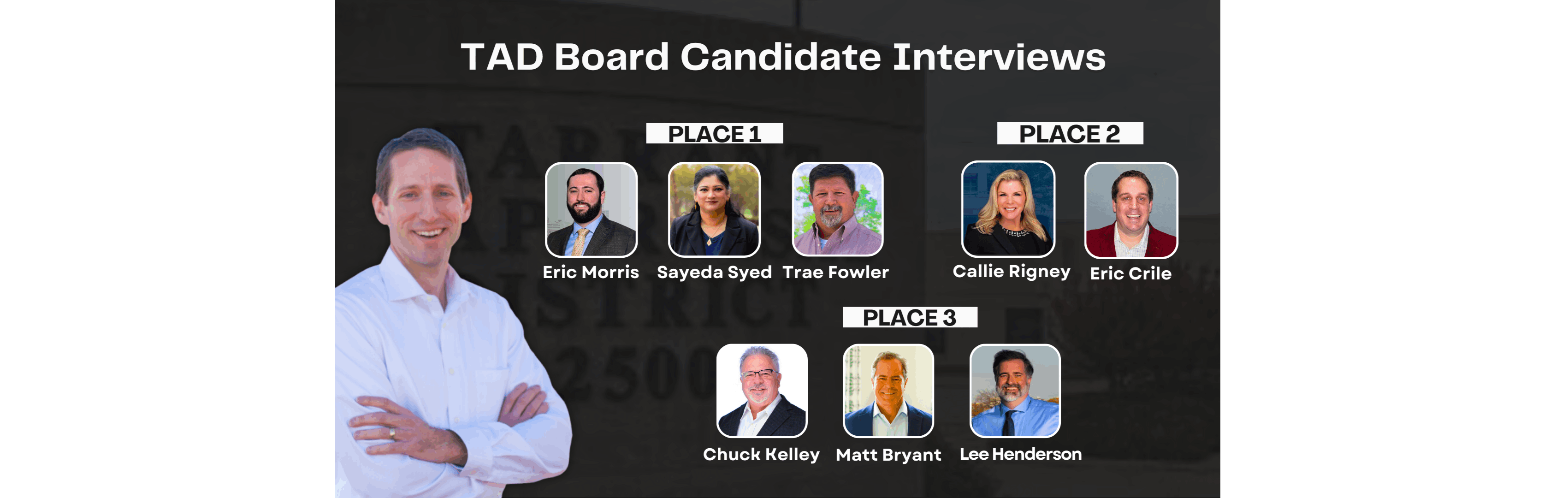

Secret Tarrant Appraisal District Election 2021

[scroll down to see TAD candidate interviews] Right now, the Tarrant County Appraisal District (TAD) is holding an election to decide who oversees the organization. TAD is the same entity that sets your property tax value and sends out the blue value notice every April. If you care about how TAD co

Read More7 Easy Ways To Slash Your Monthly House Bills

Take 5 minutes to call your lender… no really, it's easy. If your monthly mortgage payment has increased in the past year or so, it’s likely because your taxes and/or insurance have gone up. Your mortgage company likely uses a 12-month payment plan by default to pay off your escrow shortage, but

Read More-

https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

Read More HUGE Announcement & Your New Property Tax Deadlines

I fear that tax values are going to skyrocket this year. I recorded this video to share what you need to know: I bookmarked the video here: HUGE Announcement 0:45 Real estate market update 3:55 Property tax disaster exemption application 9:00 New tax protest deadlines - 10:04 Next Step

Read MoreHow you can help permanently improve property taxes

Scroll down to see a video overview of this info Step 1 Send an email and call Morgan Meyer, the chairperson for the Ways and Means Committee (contact info below). Say this: Please schedule a hearing on House Bill 2403 and House Bill 2311. HB 2403 What it does: Eliminates loophole used to rig el

Read MoreProperty Tax Legislation Bills Being Proposed in 2021

Watch Chandler's disclaimer video Passed Schwertner R, et al: SB 725 Effective on 9/1/21 Relating to the qualification of land for appraisal for ad valorem tax purposes as agricultural land and the liability for the additional tax imposed on such land if the use of the land changes as a result of

Read More14 Property Tax Warts that Should be ILLEGAL

14 Property Tax Code Proposed Solutions 0:46 Exemption Improvements Cap taxable value growth on homesteads to 5% maximum increase per year Create a single-family residential exemption capping taxable value growth at 10% per year 6:23 Improve accessibility to free help Turn "may" into "shall" S

Read MoreSecret Taxes and Shifty Ways You're Getting Gouged by the Tax Man

There are little nuances and loopholes in the law that politicians and taxing entities use to increase your taxes. This blog post is a compilation of different concerns people bring to me (in their own words) identifying these issues. I cannot vouch for the validity of these comments. I just feel t

Read MoreLegislative Preview: Addressing Citizens’ Painful Property Tax Bills

Our broken property tax system affects everybody - no matter income level, political party, homeowner, tenant or landlord. The Texas legislature isn't going to pass anything to help unless you and I let our representatives know what we care about. Everything except property tax is getting attention

Read MoreI Can't Afford My House Payment. What are my options?

My tax bill is too high. I can’t afford the house!!! Here is a list of options to consider... Reduce your insurance cost. Your house payment likely includes taxes, insurance, principle, and mortgage interest. If your payment has increased, there is a good chance your insurance rates have increase

Read MoreWhat can you do about your high taxes?

Why your property taxes are high and what you can do about it (other than protesting) Your property taxes do not go to the state but to the local entities such as: City County School Hospital College Other special taxing district depending on County What can you do about your high taxes? A. Reduc

Read More-

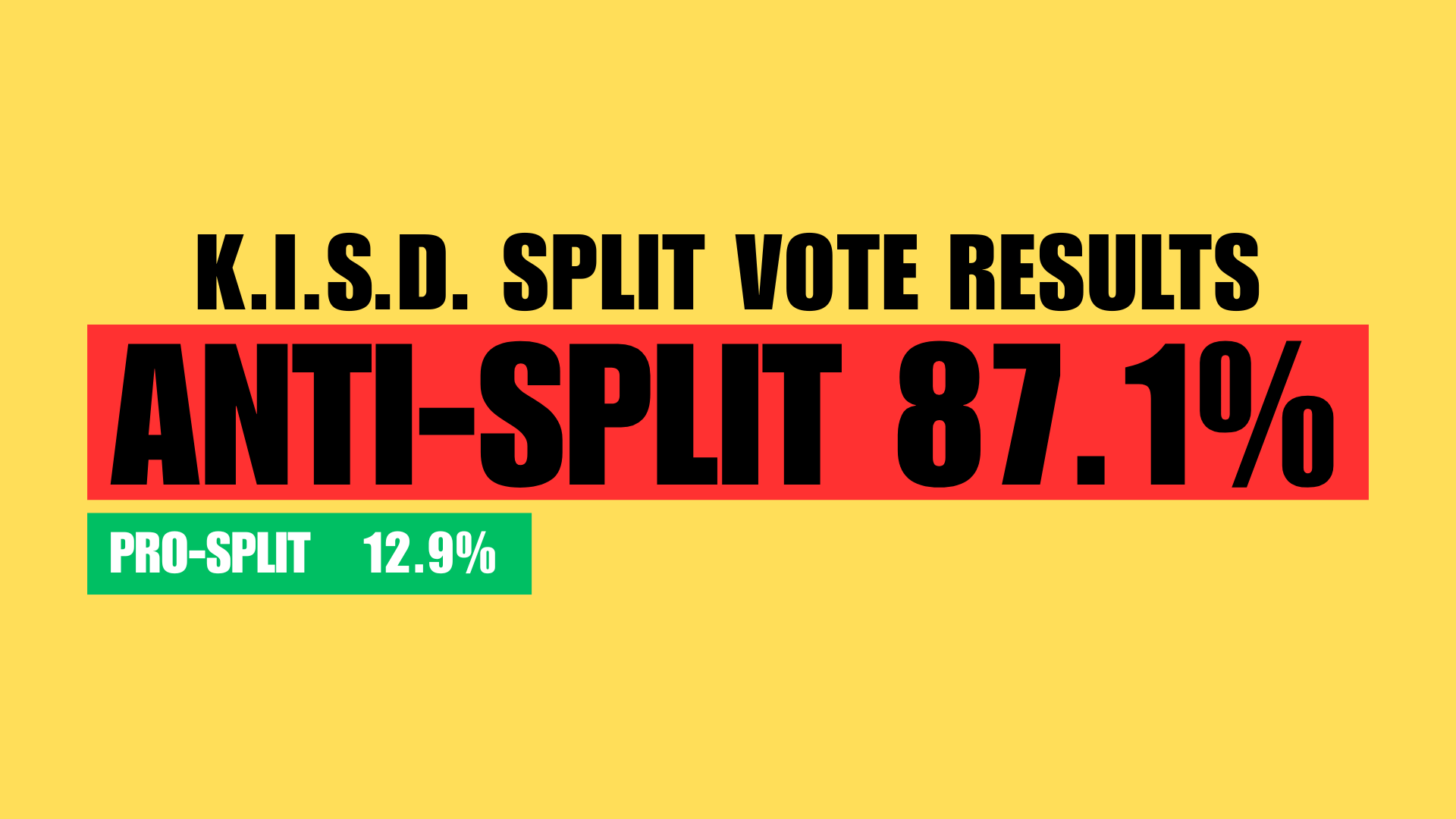

We are at the final stage of this year's tax protest. Everybody's tax protest results will be available soon. TAD's sent a little yellow postcard with a web address and it means ABSOLUTELY NOTHING! It has caused unnecessary stress and concern to everybody. It was part of the SP2 bill that was passe

Read More How to Eliminate Property Taxes - Solutions & Ideas to Consider

Protesting is a great idea, but wouldn't it be nice to eliminate the need to pay property taxes? This link explains a feasible way to eliminate a significant portion of the property taxes: https://files.texaspolicy.com/uploads/2018/06/21170102/Robin-Hood-School-Property-Tax-Belew-Sass-Ginn-Peacock.p

Read MoreProperty Tax Consultants Chandler Recommends

Every professional tax agent/consultant offers a different level of service and they often specialize in certain property types. The best way to make sure you are getting the tax agent that specializes in the area's most important to you top notch service is to talk with a few different agents and c

Read MoreCounty Appraisal Districts in Texas

Anderson CADwww.andersoncad.net Andrews CADwww.andrewscad.org Angelina CADwww.angelinacad.org Aransas CADwww.aransascad.org Archer CADwww.archercad.com Armstrong CADwww.armstrongcad.org Atascosa CADwww.atascosacad.com Austin CADwww.austincad.org Bailey CADwww.bailey-cad.org Bastrop CADwww.bastropca

Read MoreProtesting Property Tax Value Without Appearing In Person Using an Affidavit

Most people don’t know anything about this option for their property tax protest hearings. This is the Property Owner's Affidavit of Evidence form to use on your property tax protest. This is the same form that you would file if you go to the Appraisal District and file for a formal protest. Th

Read MoreNorth Texas Property Tax Appraisal Notices Delayed By COVID-19 Pandemic

Property appraisal notices usually sent to owners on or around April 1, will be delayed this year because of closures caused by COVID-19. Tarrant Appraisal District The Tarrant Appraisal District just announced that they are delaying sending out property tax value notices until May 1, 2020. Jeff La

Read MoreHow to Prepare for Your Property Tax Protest, TAD Election Results, Real Estate Market Update

This past year, we protested on over 16,800 properties. We helped draft and pass a property tax reform bill with State Representative Matt Krause and we played an integral part in the Tarrant Apprisal District (TAD) Board of Directors Election - all for free. None of these accomplishments would have

Read MoreTarrant County Property Tax Rates

Here are the updated tax rates in Tarrant County for 2019-2020 as approved by the tax entities.

Read MoreDenton County Property Tax Rates

Here are the updated tax rates in Denton County for 2019-2020 as approved by the tax entities.

Read More

Categories

- All Blogs 115

- Basics 17

- Buyer Psychology 3

- Career 1

- CCR in the News 13

- Community 19

- Downsizing 3

- Election 4

- Financial Advice 13

- Foreclosure 1

- Heritage Subdivision 3

- Home Refinancing 4

- Home Search 2

- How-to 22

- HUD Homes 2

- Just for fun 8

- Legislative Involvement 3

- Making an offer 5

- Mortgage 2

- Negotation 3

- Preparing to Sell 10

- Print media 3

- Property Tax 51

- Real Estate Market Report 24

- Robert Montoya 1

- Senior Housing 1

- State 3

- Static 1

- TAD Reform 7

- Tarrant County 10

- Testifying 2

Recent Posts