Real Estate Market Update for October 2017

Click the market update you would like to see: Fort Worth Real Estate Market Update Keller Real Estate Market Update Entire DFW Metroplex Real Estate Market Update Heritage & Crawford Farms Real Estate Market Update Discover the answers to these questions... Is it a bad idea to sell in fall

Read MoreFeatured as Realtor of the Month on New Homes Directory

We are honored to be recognized as the Realtor of the month for NewHomesDirectory.com Kelley Watkins is a terrific writer and kind soul. I am flattered by this and humbled by such an incredible team that has done so much to help so many people. If I didn't work with the best people on earth this rec

Read More6 Questions First-Time Home Buyers Never Ask Themselves (but Really, Really Should)

Realtor.com Published Our Advice in One of Their Recent Articles http://www.realtor.com/advice/buy/are-you-ready-to-buy-a-home-first-time-buyer-questions/ There's a certain point in the lifecycle of renting where you say to yourself: I just can't do this anymore. Maybe it's the upstairs neighbors,

Read More-

Real Estate Commissions Aren't Cheap, But Are They Worth It? A new independent study by Collateral Analytics shows that Realtors are indeed worth their commission, generally speaking. The study concludes that successful "For Sale By Owner" (FSBO) sellers achieve prices significantly below those from

Read More Chandler Crouch Realtors in the News!

Exciting times at Chandler Crouch Realtors! We've been featured in a number of recent stories via local news outlets. We're happy to be in a position to help so many people. Lauren Zakalik with WFAA Channel 8 interviewed Chandler on May 17th about the tax increases in Tarrant County, and what Cha

Read MoreHow to Protest Your Property Tax Value in Tarrant County and WIN!

Register on FreeTaxProtest.com and let us do the rest, all for FREE! There are 3 levels of protest Automated online protest through the Tarrant Appraisal District website Informal in-person protest (no appointment needed, just walk into TAD's office) Formal Appraisal Review Board (ARB) hearing

Read MoreChandler Crouch Named Top 3 Realtor in Fort Worth

I was completely shocked and honored to see this. This company does a 50 point inspection reviewing customer reviews, history, complaints, ratings, satisfaction, trust, and cost to find the best practitioners in an industry. They selected US!!! Chandler Crouch Reatlors is in the TOP 3 Realtors in

Read MoreThe Truth About the Keller Tennis Court Bubble Dome Proposal

There is quite a controversy surrounding a proposed 27 acre, 35 court private Birth Tennis Club at Rocky Top Ranch built by Taylor Dent will include two large bubble domes to provide a weather proof tennis facility for its members. The proposed development will be located in Keller near Johnson and

Read MoreDave Ramsey Real Estate ELP and Advice

Dave Ramsey Real Estate ELP and Advice | Fort Worth Texas If you're thinking about buying or selling a home, it would be smart to do your homework and make the best decision you can for your finances. Any real estate transaction you have is going to be among the largest financial transactions of you

Read More-

How To Find Senior (or 55+) Housing Your first step will be to make a plan on what to do with your current house. We specialize in helping seniors. Contact us for a free home valuation and to map out the best strategic plan to maximize your return and have a smooth hassle free transition into housin

Read More North Texas DFW Real Estate Market Report

The market in North Texas is hot. Watch this video for an complete market update:

Read More-

Chandler Crouch Realtors Ranked as 2017 Top Realtor by Fort Worth Magazine I am humbled to work with such a great team. Fort Worth Magazine recognized us in their Top Realtor List for 2017! We are so honored to serve this community! I can't thank you enough for your support! It's truly our pleasure

Read More How to Avoid or Transfer from a Poorly Rated School in Keller ISD

Poorly Rated Schools in Keller ISD First, I just have to say, there really isn't such thing as a bad school in Keller ISD. Some may not be rated quite as high as another, but if you've ever been to a truly bad school, you'd this article is just focused on the difference between GREAT schools and BES

Read MoreNEWS: Secret Interview About Bubbles Makes the News

This is exciting! I hope this never gets old. I found this in my inbox this morning: After discussing real estate bubbles with superb journalist Andrew DePietro, he wrote 2 articles and used our company as a source! This guy writes incredibly well. See what Andrew has to say about real estate bu

Read MoreIs TX in a Housing Bubble? and my Forecast

I wrote this in bullet point format to save you time. My take on housing: Employment and housing are related. We have experienced way above average growth in employment, incomes, and overall prosperity and it’s reflected in home values increasing. Not to mention in a period before our boom home pri

Read MoreHow to Get a Job: Lessons learned from 257 applicants in 10 days.

We recently hired to fill an entry level position at our company. When a job posting includes "No experience is required," "full benefits," and being voted "Best Place to Work in Keller," it attracts a good amount of attention... We were shocked (and very thankful) to receive 257 applicants in about

Read MoreMENTION: Jesus, Fox News, and Chandler Crouch Realtors

I was shocked to learn where a prospective buyer found our website... foxnews.com!!!! It turns out that Realtor.com published another quote from us. This time Fox News and all sorts of other folks are re-posting the article. Take a look, its worth a read: http://www.foxnews.com/leisure/2016/06/14/s

Read MoreWFAA: Dallas County Judge Calling for Property Tax Rate Reduction

Dallas County Judge Clay Jenkins is calling on local governments to lower their tax rates to offset higher property valuations. That way, they would still get the money they were planning on without "overtaxing" home and business owners. DALLAS -- Last spring, the Dallas County Central Appraisal Dis

Read MoreRANKED: #1 Realtor in Fort Worth. The winner is...

You guessed it! Chandler Crouch Realtors was voted #1 in Fort Worth! We are very grateful for all your support. We definitely have the best clients in Fort Worth! This is only because of YOU! Thank you! http://blog.choicehomewarranty.com/the-15-best-real-estate-agents-in-fort-worth-tx/

Read MoreMENTION: Realtor.com on buyer negotiation techniques

We're blown away... Realtor.com featured us again in one of their articles. This time Chandler is quoted about savvy buyer negotiation techniques. http://www.realtor.com/advice/buy/craziest-tactics-to-buy-a-home/

Read More

Categories

- All Blogs 115

- Basics 17

- Buyer Psychology 3

- Career 1

- CCR in the News 13

- Community 19

- Downsizing 3

- Election 4

- Financial Advice 13

- Foreclosure 1

- Heritage Subdivision 3

- Home Refinancing 4

- Home Search 2

- How-to 22

- HUD Homes 2

- Just for fun 8

- Legislative Involvement 3

- Making an offer 5

- Mortgage 2

- Negotation 3

- Preparing to Sell 10

- Print media 3

- Property Tax 51

- Real Estate Market Report 24

- Robert Montoya 1

- Senior Housing 1

- State 3

- Static 1

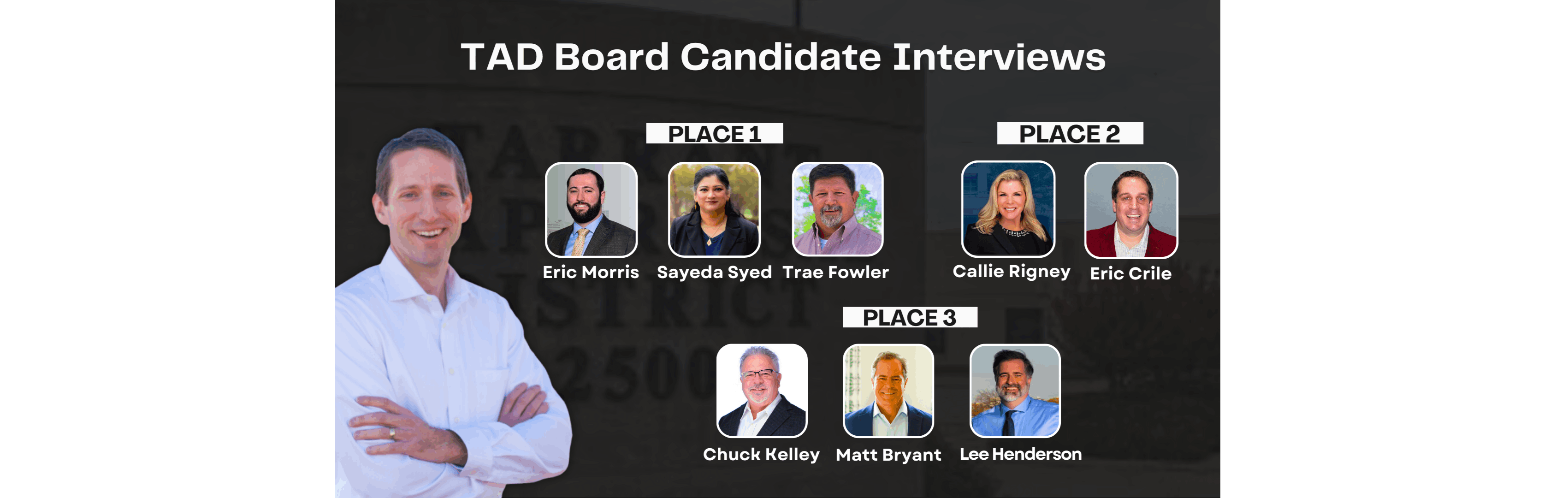

- TAD Reform 7

- Tarrant County 10

- Testifying 2

Recent Posts